- January 24, 2026

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The post Will RIVER Price Hit $100 in Q1 2026? appeared first on Coinpedia Fintech News

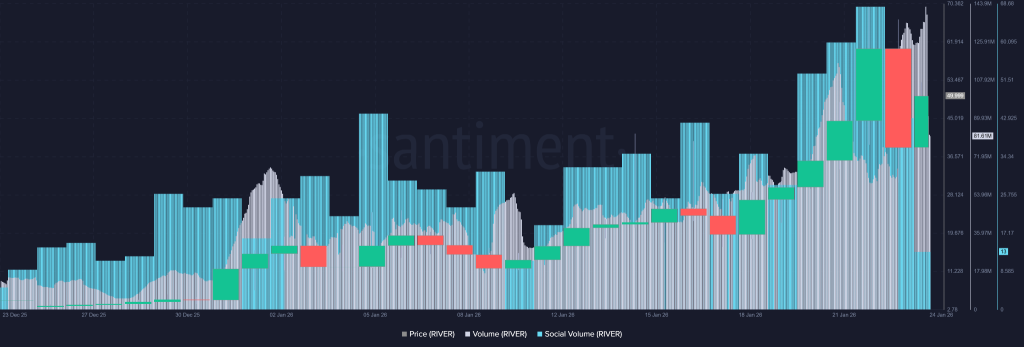

The RIVER price has emerged as one of January’s most closely watched mid-cap crypto moves, driven by a convergence of positive developments, including exchange listings and fresh institutional funding. RIVER is drawing attention far beyond, and its parabolic price action is evident, making this an asset on every investor’s and trader’s watchlist.

RIVER Price Gains Traction Amid Exchange Listings

To begin with, the RIVER price rally came from multiple factors that included new exchange exposure. On January 20, RIVER was listed on Coinone with a KRW trading pair. As a result, spot liquidity increased sharply, daily volumes surged, and market participation broadened, particularly from the South Korean trading community.

Even social activity followed quickly, with rising mentions and speculative positioning becoming more visible across derivatives platforms.

Shortly after, on January 22, another tailwind arrived. RIVER was listed on the “Lighter platform” alongside other established assets, with access to 3x leverage. This move triggered high derivatives interest, which pushed its price further to $72.

Fundamental Expansion Supports RIVER Crypto Narrative

Beyond exchange listings, its fundamentals and ecosystem developments also aided this rally. Notably, when RIVER announced an integration with the Sui ecosystem, enabling liquidity teleportation into Sui via satUSD.

This development strengthened its Omni-CDP model, which aims to reduce dependence on traditional cross-chain bridges. As a result, RIVER crypto gained traction as an infrastructure-focused project rather than a purely speculative asset. The strong vision and utility to the market attracted interest from top expert institutions.

In addition, River confirmed on X that in January, a $12 million strategic funding round included institutional participants from the US and Europe, alongside major crypto ecosystem players such as Justin Sun, Arthur Hayes, and the Spartan Group. While the price reacted sharply, this capital injection also validated RIVER’s long-term cross-chain ambitions.

RIVER Price Chart Reflects Explosive Momentum

From a technical perspective, the RIVER price chart highlights one of the strongest monthly expansions among mid-caps. Following a golden cross between the 20-day and 50-day EMAs, the price surged from roughly $7 to near $72, translating into gains exceeding 900% at the peak. Although the price later retraced toward $49.72, the RIVER price USD remained up nearly 600% on a monthly basis.

Throughout January, price respected an ascending channel on the daily timeframe. Importantly, the recent breakout above this channel shifted former resistance into support near the $38 zone. This structure now serves as a pivotal technical level, shaping short-term expectations around any RIVER price prediction.

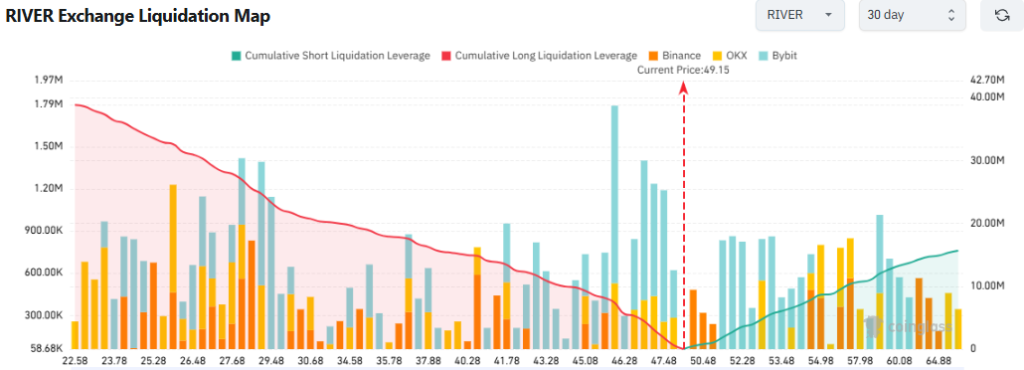

Leverage Data Signals Elevated Volatility

Meanwhile, derivatives data added another dimension to the RIVER price forecast. Over $38 million in cumulative long liquidations contributed to upside pressure during January, while short liquidations lagged near $15.6 million. Currently, the $50–$60 range hosts dense short-side liquidation clusters, with the $59 level alone accounting for roughly $12 million. Should price reclaim this zone convincingly, upside volatility could increase sharply toward the $80–$100 range.

At the same time, failure to hold above $38 may expose downside risk toward the $25 support area, underscoring that leverage remains a double-edged sword for RIVER’s price dynamics.